Banking & Stock Market Security Platform (BSMSP) @Hak Securities Order At Home

About

Established in 1990, HAK is a securities and futures brokerage firm situated in Istanbul, Turkey. As a proud member of the Istanbul Stock Exchange (ISE) and the Turkish Derivatives Exchange (Turkdex), the company also holds a minority stake in Takasbank A.Ş., the central clearing and settlement bank. HAK Securities introduced its market data transfer platform in 1998 as a pioneer in trading technologies. Its primary activities revolve around ISE securities, Turkdex futures, and government bonds. In 2012, PhillipCapital acquired Hak Menkul Kiymetler A.S. ("HAK") to broaden its market reach and capitalize on the burgeoning growth of the capital markets in Turkey and the surrounding region.

Recognized as the "Best Retail Broker" in consecutive years (2010-2011) at the SIAS Investors' Choice Awards, Phillip Securities, a member of PhillipCapital, stands as Singapore's foremost stockbroking house. Over the past 36 years, PhillipCapital has emerged as a leading integrated Asian financial institution, boasting a global network of offices. It offers an extensive range of innovative financial products and services tailored to both retail and corporate clients.

In the present day, PhillipCapital operates in the financial hubs of 13 countries, namely Singapore, Malaysia, Indonesia, Thailand, Hong Kong, China, Japan, Sri Lanka, Turkey, the United Kingdom, France, Australia, and the USA.

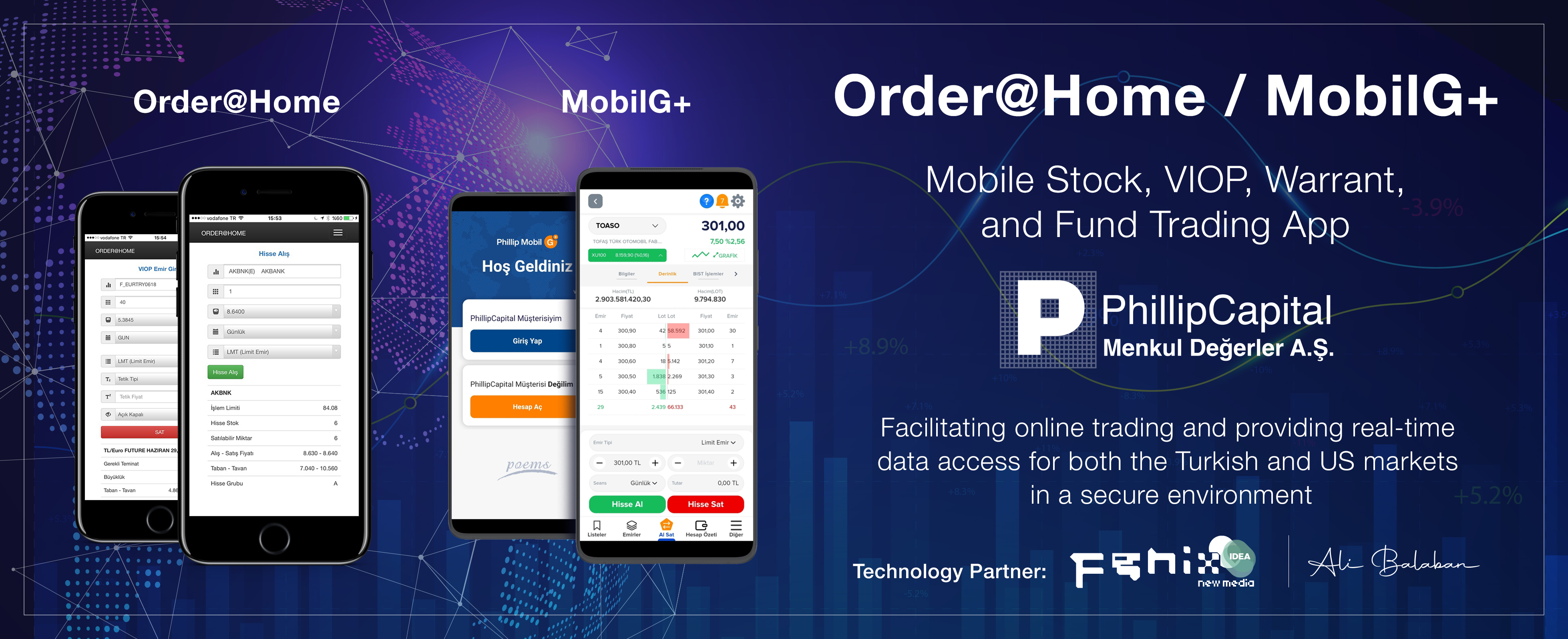

In 1998, HAK Securities embarked on a technological advancement initiative by launching a project named Order@Home to provide investors with market data through the Internet. By the early 2000s, Order@Home expanded its platform, enabling investors to conduct stock market transactions. However, the system faced significant challenges in both technical and marketing aspects, and optimal efficiency was not achieved until 2008.

Recognizing the need for improvement, HAK Securities sought the expertise of FenixIdea to optimize the system, enhance transaction speed, and bolster security for online transactions. Following a thorough system analysis, my team and I devised a solution to fortify the platform against data breaches and integrated the EX9API system to address speed concerns. Consequently, the total transaction volume in the stock market over the Internet reached 1,281,019,456 TL, maintaining a second-level transaction speed in 2010.

As a consultant, I formulated functional requirements for Hak Securities, specifically focusing on segregating the mobile platform from the core back-office systems.

Thanks to my contributions, we have continued to deliver services for Order@Home, subsequently rebranded as MobilG+, following the acquisition of Hak Securities by PhillipCapital in 2012. The current iteration of MobilG+ enables investors to trade stocks online and access real-time data for both the Turkish and US markets. In my initial involvement with MobilG+, I assisted the firm's IT team in integrating the TradingView chart platform into the application. I also played a key role in defining features such as live data feeds, displays for pending orders, order modifications (drag & drop functionality), order cancellations, and the ability to save and load custom charts.

I continue to support the MobilG+ platform as a consultant, aiming to enhance the efficiency of the application.

Visit MobilG+